Solo 401k employer contribution calculator

2019 and 2020 Solo 401k Maximums. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

Solo 401k Contribution Limits And Types

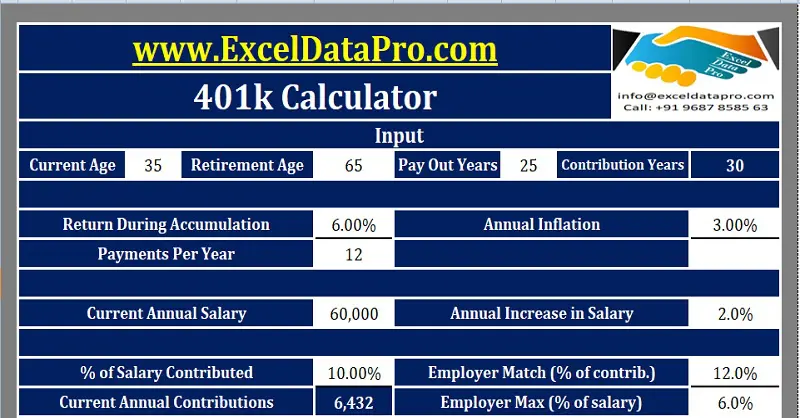

In the following boxes youll need to enter.

. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan.

The 2020 Solo 401k contribution limits are 57000 and 63500 if age 50 or older. Elective deferrals up to 100 of compensation earned income in the case of a self-employed individual up to the annual contribution limit. An employee contribution of for An employer.

The contribution limits for a Solo 401k plan are very high. The table below shows the contribution amounts and maximums for 2019 and 2020. The employee calculation for a Solo 401k is pretty straightforward.

Your expected annual pay increases if any. Your annual gross salary. This is up from 57000 and 63500 in 2020.

How are the Solo 401k contribution limits calculated. Contribution limits to a Solo 401k are very high. This formula works to determine employees allocations but your own contributions are more complicated.

To calculate your Solo 401 k Plan maximum contribution please input the information in the calculator. The 2022 Solo 401k contribution limits are 61000 and 67500 if age 50 or older 2021 limits are 58000 and 64500 if age 50 or. Specifically you are allowed to make.

The owner can contribute both. How frequently you are paid by your employer. You can invest up to.

Enter your name age and income and then click. IRS Publication 560 has more information. But remember these are the solo 401k cap.

Solo 401k Contribution Calculator allows you to calculate the maximum amount you can contribute to your plan. To determine your Solo 401k maximum take Employee Contribution Employer Contribution. To remove the PDF.

A PDF document will be created that you can print or save. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Click on the link below enter requested info below and click the. You can contribute up to 57000 per year and 63000 per year if you are age 50 or older. You cant simply multiply your net profit on Schedule C by.

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

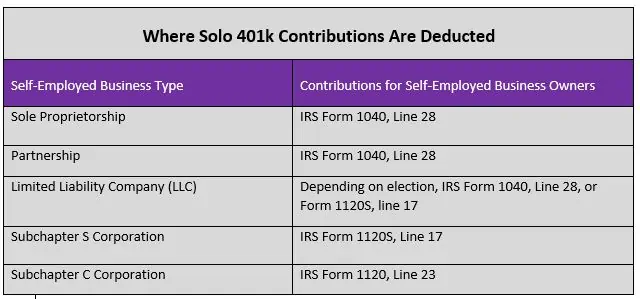

Solo 401k Contribution And Deduction

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

401k Contribution Calculator Best Sale 58 Off Www Ingeniovirtual Com

Solo 401k Contribution Limits And Types